salt tax impact new york

22 2017 established a new limit on the amount of state and local taxes SALT that can be deducted on a federal income tax return. After legislators realized the impact of this it was decided to simply reduce the SALT deduction to 10000.

Why This Tax Provision Puts Democrats In A Tough Place Time

Determine possible cash flow and distribution implications.

. Beginning in 2018 the itemized deduction for state and local taxes paid will be capped at 10000 per return for single filers head of household filers and. Almost 11 million taxpayers are likely to feel the pinch of a new cap on deducting state and local taxes also known as SALT deductions. Enacted through the Republicans 2017 tax overhaul the SALT cap has been a pain point for costly states like New York and New Jersey because residents cant deduct more than 10000 in state and.

52 rows The SALT deduction is only available if you itemize your deductions using Schedule A. 39 minutes agoNew York Rep. On April 19 2021 New York Governor Andrew Cuomo signed into law legislation that creates a New York Pass-Through Entity Tax effective for tax years beginning on or after January 1 2021.

As New York State reckons with the vast economic impact of COVID-19 including a workforce depletion of. The Rockefeller Institute of Government and the New York State Division of the Budget have examined the impact of the SALT cap. Unchanged is the SALT state and local income tax deduction cap.

The bill passed on Thursday includes some budgetary gymnastics in order to avoid. The federal tax reform law passed on Dec. Starting with the 2018 tax year the maximum SALT deduction available was 10000.

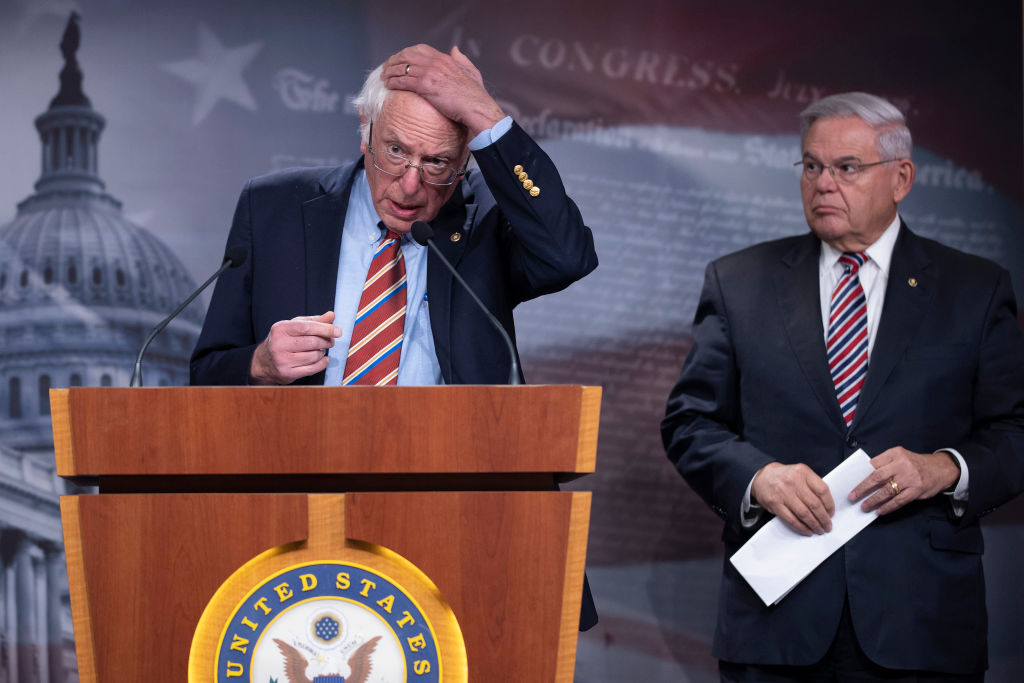

The tax plan signed by President Trump in 2017 called the Tax Cuts and Jobs Act instituted a cap on the SALT deduction. New York supports 107000 fewer additional. Tom Suozzi speaks during a news conference announcing the State and Local Taxes SALT Caucus outside the US.

The SALT cap increase will have the biggest effect on high-income-tax states like New York California and New Jersey said certified financial planner Matthew Benson owner at Sonmore Financial. Cuomo donned rose-colored glasses Wednesday as he tried to assure the states most affluent residents that. The change may be significant for filers who itemize deductions in high-tax states and.

This report shows that the cap which is effectively a tax increase for New Yorkers is having a sustained negative effect on employment and output in New York State. For your 2021 taxes which youll file in 2022 you can only itemize when your individual deductions are worth more than the 2021 standard deduction of 12550 for single filers 25100 for joint filers and 18800 for heads of household. ALBANY New York and three other states are appealing a federal court ruling that struck down their lawsuit against the Trump Administrations 10000 cap.

The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returns. About 10 percent of tax filers with incomes less than 50000 claimed the SALT deduction in 2014 compared with about 81 percent of tax filers with incomes exceeding 100000 the Tax Policy. This consequential tax legislation available to electing pass-through entities provides a mechanism for New York State individual taxpayers to limit the impact of the.

New York nonresident owners need to consider the impact to their resident state filings eg ability to receive a credit for taxes paid under the PTE regime. Apr 07 2021 at 552 pm. For S corporations wishing to utilize the PTET ensure proper New York S election is on file.

With the SALT limitation in place New Yorkers who already send 40 billion more in taxes to federal coffers than the state receives in return face the manifestly unfair risk of being taxed twice on the same income Nadler said. The impact of the SALT deduction will change somewhat however as a result of the TCJA. Before President Donald Trump signed the Tax Cuts and Jobs.

The 10000 limit on the amount of state and local taxes deductible from federal income was enacted in 2017 and sunsets after 2025 under current law. On a most superficial level it might seem obvious that the TCJA provision capping state and local tax SALT deductions at 10000 would have to represent a tax increase for many middle-class residents of high-taxed states like New York where property taxes on a downstate suburban house can approach or exceed the limit. The SALT cap was tucked into the 2017 tax overhaul in part to help finance it and reduce its impact on the deficit.

House Democrats spending package raises the SALT deduction limit to 80000 through 2030. The cap disproportionately impacts expensive high-tax Blue States including New York where its exacerbated the effect of. The Joint Committee on Taxation estimates that the number of taxpayers who itemize instead of taking the standard deduction will fall from 465 million in 2017 to just over 18 million in 2018.

Behind the decrease in itemizers and increase in taxpayers taking the standard. Capitol April 15 2021.

The Salt Deduction There S A Baffling Tax Gift To The Wealthy In The Democrats Social Spending Bill The Washington Post

New Direction Designs For Breaktime Massage Pefect Hour Flyer Massage Therapy Wellness Massage Massage Benefits

Pin By Tami Mizrachi On My Books In 2022 Book Lovers Novels Books

Nyc Home Prices Plunge After Salt Deductions Capped

Pin By Ashutosh Dodamani On Amazing Nature Amazing Nature Golden Gate Bridge Golden Gate

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

New York Enacts Pass Through Entity Tax Election As Salt Deduction Workaround Our Insights Plante Moran

/cdn.vox-cdn.com/uploads/chorus_image/image/70105881/1236366936.0.jpg)

What Proposed Salt Changes Could Mean For Your Next Tax Bill Vox

Photo By Jason Chen Unsplash Taiwan Travel Singapore Travel Taipei

Ast Week The United States Fish And Wildlife Service Which Is Part Of The U S Department Of The Lake Michigan Chicago Indiana Dunes State Park Indiana Dunes

1940 Country Store Gas Station Melrose Louisiana Old South Etsy Gas Station Old General Stores Old Country Stores

Pin By Ashutosh Dodamani On Amazing Nature Amazing Nature Golden Gate Bridge Golden Gate

Large Chalice Vase Sm 179 10153

Mit Reopens Oculus Atop Great Dome Architecture College Architecture Classical Architecture

San Francisco S Painted Ladies In The Alamo Square Neighborhood Is One Of The Most Photographed Loc San Francisco Restaurants San Francisco Visit San Francisco

Austin Texas Skyline Peel And Stick Wall Mural Peel And Stick Wallpaper Home Decor Wall Art Limitless Walls